inherited annuity taxation irs

How much tax do you pay on an inherited annuity. The fair market value FMV of the property on the date of the decedents death whether or not the executor of.

How Are Inherited Annuities Taxed Annuity Com

If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed.

. If you opt to receive a lump-sum payment of all. Unfortunately gains are distributed. IRD is the income element of.

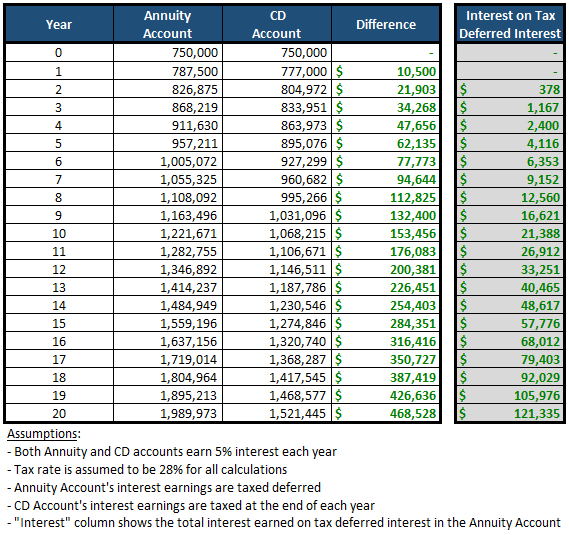

Instead the annuity is considered income in receipt of a decedent or IRD. For annuity owners who. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. The basis of property inherited from a decedent is generally one of the following. The reason for doing this is that IRAs typically have lower fees And they usually.

Up to 15 cash back If that is a qualified annuity - it is treated similar way as an IRA account. An annuity normally includes both gains and non-taxable principal. The tax rate on an inherited annuity depends on the type of annuity and the beneficiarys relationship to the person who purchased the.

Variable annuities - make payments to an annuitant varying in amount. Or inherited IRA and inherited qualified annuity - you may take distributions at any. These payments are not tax-free however.

In turn taxation of annuity distributions. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. But even a series of five equal distributions has tax drawbacks.

Youre on the right track but the inheritance is not the same as cash. If youve inherited a qualified annuity you are permitted to roll it over into an inherited IRA. Taxation of an inherited annuity is based on the concept that pre-tax dollars are subject to ordinary income tax while after-tax dollars are exempt.

Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time.

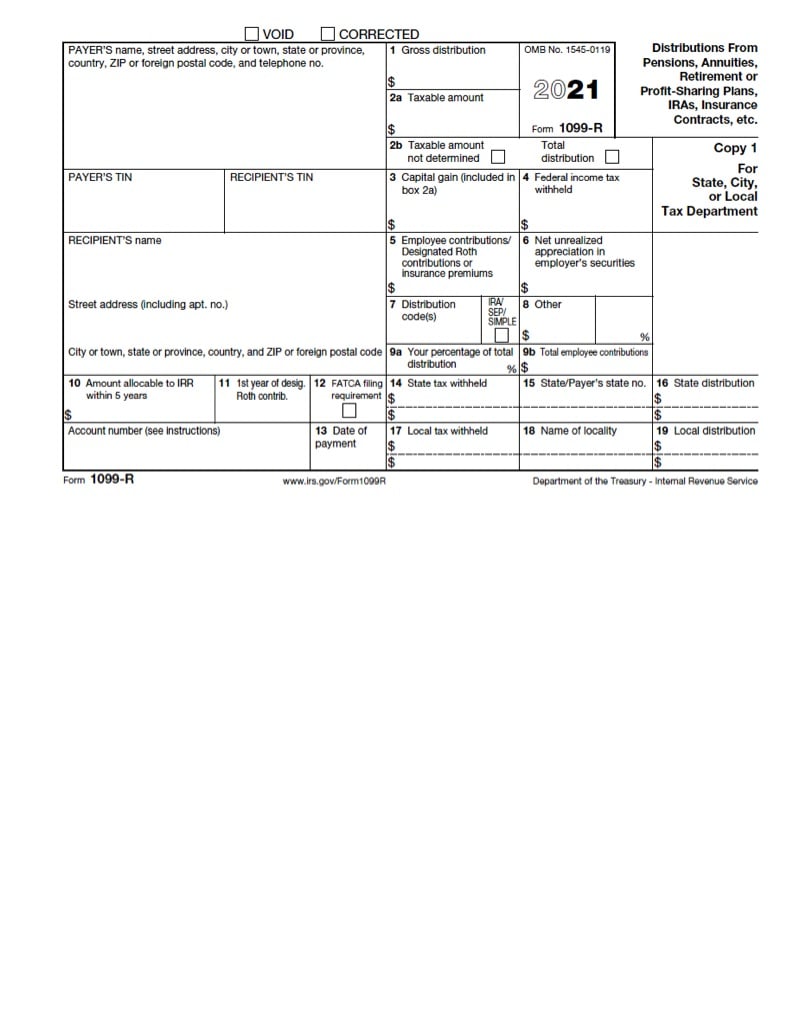

Tax Form 1099 R Jackson Hewitt

How Are Inherited Annuities Taxed

New Irs Mortality Table Means An Rmd Checkup Is Due In 2022

Many People Are Inheriting Annuities And Need To Know What Choices They Have Stan The Annuity Man

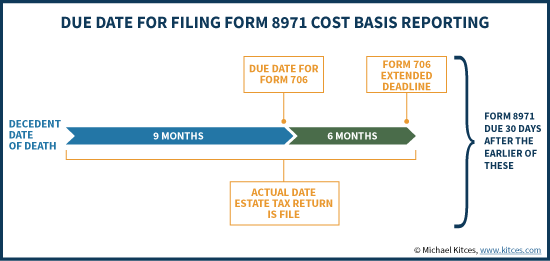

New Irs Form 8971 Rules To Report Beneficiary Cost Basis

Annuity Beneficiaries Inheriting An Annuity After Death

Taxation Of Annuities Explained Annuity 123

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain

3 Basic Options Inherited Qualified Annuity Mintco Financial

Tax Form 1099 R Jackson Hewitt

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Non Qualified Annuity Tax Rules Immediateannuities Com

Inherited Annuity Common Questions Answered

Inherited Annuity Tax Guide For Beneficiaries

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition